We’re more than three weeks into our new budget plan, and it seems to be going fairly well. With only a week left, I’m actually looking forward to the end of the month, hoping we’ll come in under our budgeted amounts in some of the categories.

We’re more than three weeks into our new budget plan, and it seems to be going fairly well. With only a week left, I’m actually looking forward to the end of the month, hoping we’ll come in under our budgeted amounts in some of the categories.

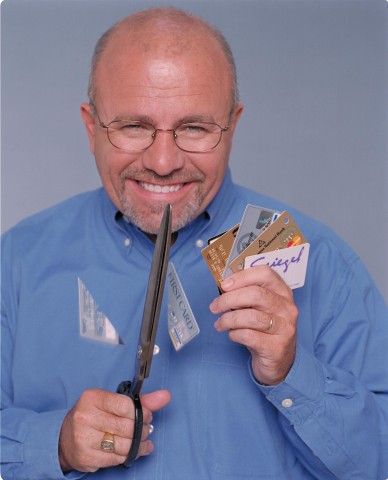

We decided to wean ourselves from credit card use, with the exception of online purchases. The first time I had to fill up my car sans credit, I found myself staring stupidly at the gas pump; I didn’t know what to do. As it turns out, I’ve never bought gas with a debit card – I’ve always used credit (or cash, back in high school). Since my debit card can also work as a credit card, I have to be careful – I don’t want any surprises at the end of the month.

Kathy does almost all of the recording on our handy budget spreadsheet, whenever we spend money. “It’s kind of fun,†she claims. I can’t see how that could be, but leave it to my Kathy to find a positive angle. “It is cool to get control over our finances,†Kathy insists.

Personally, I don’t see much fun in it. I chafe under the restriction of the budget, a lot more often and a lot more sharply than I thought I would. Kathy hoards her grocery and household money, but I don’t really have any category that I can manage except for “Tim’s Unaccountableâ€, which is my monthly cash allowance. So many of our expenses are fixed or outside our immediate control … it makes me sad.

Daniel can’t handle the stress of the new budget.

One of the factors which made it scary and difficult for us to start this budget plan was a series of unexpected expenses that threatened to overwhelm us. It has been interesting to see how God is dealing with that, especially since we were nearly deterred from our budget plan altogether. As I constantly remind myself, “without faith, it is impossible to please God.†How foolish we would be if we let our fears rule our hearts, instead of trusting in our Father, who loves us.

| Expense | Expected Cost | Actual Cost |

|---|---|---|

| Kathy’s Root Canal | $1200 | $274 |

| Tim’s Implant | $1800 | $1280 |

| Lawn Mower | $175 | $155 |

| New Roof | $11,000 | Still unknown, but there seems hope that a cheaper alternative may emerge. |

| Brakes for Kathy’s car | $600 | Deferred until May |

| Homeschooling Materials | $600 | Deferred |

Not our actual roof …

Since we started budgeting, we’ve had an influx of cash and the promise of cash. First, our income tax refund was larger than anticipated and arrived much earlier than expected. Next, we found that we’ll qualify for the maximum stimulus tax rebate, to be paid out in the third week of May. Out of the blue, I received a letter from my uncle, informing me of a small inheritance from my grandmother’s estate, likely to be disbursed some time this Spring. Finally, just today I received notification of my company’s quarterly bonus (it usually amounts to a week’s extra pay) to be paid out in early May.

In the tub there are no worries.

It is good to be reminded how much God loves us and cares for us. While I don’t expect God to open the windows of heaven every month, it is comforting to see that God is master of the “just in time†inventory philosophy. We’ve been able to meet our immediate needs and to begin to save toward a new roof, something I thought for sure would place us further into debt.

Not that we’d mind having the windows of heaven open every month …

I don’t really have any excuse for being fearful about money. God has taken good care of our family, time and time again. I’m a little embarrassed to have to learn this lesson all over again.

I’m planning, if I can find the time, to create a sidebar graphic that will display our progress, month over month, in reducing our debt. I’m not going to post how much we owe, but I think I’ll show the percentage reduced, so you can encourage us, hold us accountable, and perhaps be encouraged in turn. We’re in this for the long haul this time, unlike previous flash-in-the-pan budgetary attempts. I’m hereby publicly committing to a minimum of six months of sticking to our budget. I know that may seem pretty lame to some, but for Kathy and me, it is a big commitment, so please bear with us.

I’m planning, if I can find the time, to create a sidebar graphic that will display our progress, month over month, in reducing our debt. I’m not going to post how much we owe, but I think I’ll show the percentage reduced, so you can encourage us, hold us accountable, and perhaps be encouraged in turn. We’re in this for the long haul this time, unlike previous flash-in-the-pan budgetary attempts. I’m hereby publicly committing to a minimum of six months of sticking to our budget. I know that may seem pretty lame to some, but for Kathy and me, it is a big commitment, so please bear with us.

Thank you to the many readers who commented on the last two money-related blog entries – we have been blessed and delighted with the quality and quantity of godly advice and encouragement many of you have offered.

Tim

Project 366 – Day 115